Australian Asking Rents Surging Beyond Wage Growth Records

Capital City asking rents have experienced remarkable fluctuations. Recent annualised rental growth rate has peaked at 33.1% in March 2023. This surge, while slowing to 5.7% (annualised) in September 2023, outpaces wage growth as measured by the Wage Price Index (WPI), raising questions about how the nation will address the increasing affordability crisis. It further asks the question of how Build to Rent (BTR) can help.

The following research is based on Franklin St. analysis and data from the ABS and SQM Research.

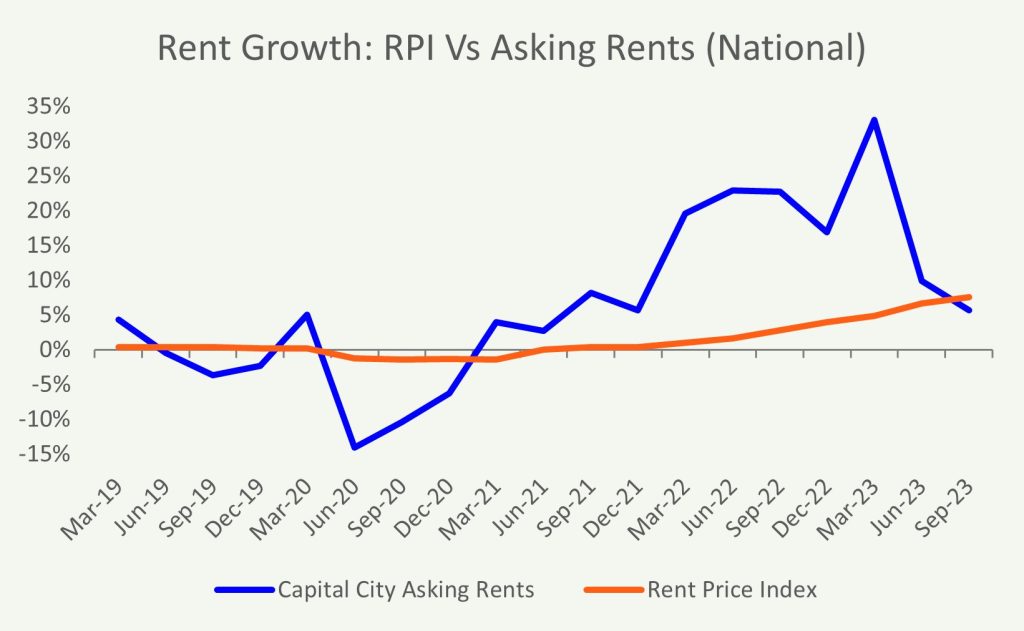

Volatility in Capital City Asking Rents

The historical data showcases the rollercoaster ride of asking rents from March 2013 to September 2023. Noteworthy moments include a remarkable 10.1% (annualised) surge in March 2016, followed by a -14.1% (annualised) dip in June 2020 as lockdowns took effect. More recently, asking rents were growing at 33.1% in March 2023 before plateauing towards 5.7% in September 2023.

This extreme growth rate, as shown in the included charts show the huge break from wage growth that has taken part in the Australian market and reflects the pain that is being felt on household budgets, for both renters and homeowners (who have been exposed to increasing mortgage costs.)

Further, Franklin St. believe that supply constraints in the rental market, combined with continued strong population growth forecasts, will only place further pressure on asking rents in the years to come. This comes at a time when businesses are also struggling and unlikely to increase wages in any meaningful way.

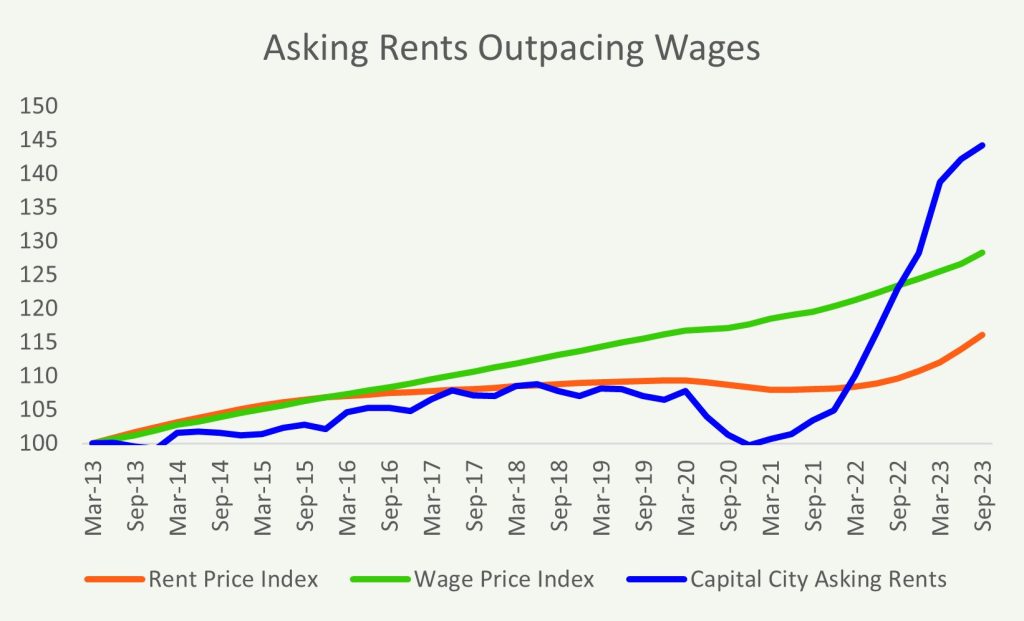

Wage Growth Outpaces Rental Indices

Whilst asking rents are seasonal and have shown recent wild swings, the Wage Price Index has shown consistent growth since 2013. Over this period, wages have actually outpaced the rental price index. The WPI’s historical record pace of 1.3% quarterly growth (5.2% Annualised) in the September 2023 highlights the resilience of wage growth, which has in fact outpaced actual rents to stand at 128, compared to the rental index at 116.

However, asking rents are a good leading indicator for actual rents. The recent extreme up ticks in asking rents are only now starting to show through in the rent index, Franklin St. are confident that the rent index will soon outpace wage growth over the journey.

In conclusion, the juxtaposition of asking rents against wage and rental indices signals a need for innovative solutions. As Australia grapples with rental affordability challenges, the Build to Rent sector emerges as a solution to supply imbalances, promising a future where housing options cater to the diverse needs of the population.

Franklin St. stands as a guiding force, advocating for a balanced and sustainable rental market.

Published: November 2023

Learn more about The BTR Equation.